May 19, 2016

The following content is from the May edition of the Business Forecast newsletter, sponsored by Silvergate Bank. To get these updates directly to your inbox, sign up here.

Business Forecast Highlights:

- BOI drops significantly back down to 19.4

- Business confidence for hiring takes a hit

- Firms sensitive to minimum wage increases are spooked

- Minimum wage increase seen as most damaging state regulation

- Hospitality, retail, manufacturing and healthcare hit hardest by increasing minimum wages

Looming wage hike creates most angst in North Inland region, and in retail and hotel industries

- BOI drops significantly back down to 19.4

- Business confidence for hiring takes a hit

- Firms sensitive to minimum wage increases are spooked

- Minimum wage increase seen as most damaging state regulation

- Hospitality, retail, manufacturing and healthcare hit hardest by increasing minimum wages

The County’s Business Outlook, which surged last month to the highest point since June 2015, has reversed and is now back down to 19.4 where it was in February. The BOI is nine points lower than a year ago and four points lower than its 50-week average of 23.2. The main factors dragging the Outlook down are a waning confidence in hiring and the imminent increase in the minimum wage.

Business confidence for hiring new employees has dropped with only 28 percent of firms reporting they will be bring on at least one new employee, down from 35 percent last month, while 8 percent anticipate letting employees go. The negative effect of the minimum wage increase is seen across all four of the Index’s metrics: hiring, employee hours, revenue predictions, and business conditions. In addition, the number of companies reporting minimum wage as a new challenge this month has more than doubled from 5 percent to 12 percent.

Businesses citing minimum wage as a new challenge report a poor BOI of -6, while the average for those who do not mention the minimum wage is 23. In fact, 45 percent of firms with minimum wage concerns fall into the “danger zone” where the BOI is less than 12.5. Businesses in the danger zone are candidates for moving out of California.

On the bright side, concerns over an increasing minimum wage are not a problem for some local industries. Cyber firms anticipate increasing hiring during the next three months.

By business size, we see that large businesses are feeling the minimum wage strain most. Firms with more than 50 employees went from a BOI of 28 to 15 currently.

Geographically, businesses in the north inland corridor report more negative effects from minimum wage increases. Businesses in these areas, which includes the Vista Chamber of Commerce, Escondido Chamber of Commerce as well as some members of the San Diego Regional Chamber of Commerce, saw their outlook drop by 15 points in the last month, going from 32 to just 16.

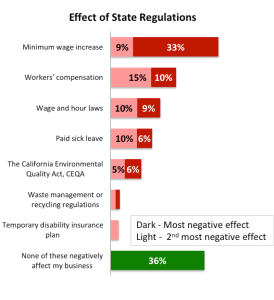

This month’s survey asked what state regulations, if any, have the most negative effect on their business. Not surprisingly, an increasing minimum wage tops the list. Workers’ compensation is the second most burdensome state regulation, regarded as a problem by one-quarter of the business community. Serious complaints about wage and hour laws, paid sick leave, and the California Environmental Quality Act all garner more than 10 percent of the total responses.

Effect of State Regulations: The impact of a minimum wage increase varies by industry. Some, such as hospitality and restaurants that tend to have many hourly workers, are far more sensitive to minimum wage increases than others. Six out of ten hotels and restaurants in San Diego County see a minimum wage increase as seriously harming their business. Paid sick leave is also a top issue for the hospitality and restaurant business with 36 percent saying it’s a regulation that negatively affects them.

However, the impact of minimum wage is worst among those in the retail industry. In that sector, 54 percent say it has the most negative impact of all the state regulations, and 69 percent saying it has an effect. Manufacturing is another sector that suffers under a rising minimum wage. Most surprising is the finding that the healthcare and medical field sees minimum wage increases as a problem. Forty-three percent of those businesses see it as the regulation having the biggest negative effect and two-thirds see it as a problem for them.

ABOUT THE BUSINESS FORECAST

The San Diego County Business Forecast, sponsored by Silvergate Bank, is a scientific look at where our region’s economy is headed. The survey for this month’s installment was fielded April 14-29, 2016 by Competitive Edge Research & Communication using responses from 232 randomly-selected members of the San Diego, East County, Alpine, Escondido, Lakeside, Vista, Santee, and National City Chambers of Commerce. All Chamber members are invited to complete the survey either online or over the phone.

The Business Outlook IndexTM (BOI) is comprised of four self-reported assessments regarding the next three months: Will a respondent’s business increase or decrease its number of employees, experience an increase or a decrease in revenue, increase or decrease the number of hours its employees work, and experience an improvement or a worsening of business conditions. For each assessment, definite and positive responses are scored 100, probable and positive responses are scored 50, neutral responses are scored 0, probable and negative responses are scored -50 and definite and negative responses are scored -100. The scores are summed and divided by 4 to get a range for the BOI of -100 to +100, with zero being a neutral outlook. Visit https://sdchamber.org/businessforecast to see past Business Forecasts.

ABOUT SILVERGATE BANK,BUSINESS BANKING REDEFINED

For over 25 years, as a San Diego based community bank, Silvergate provides a rewarding banking experience where the client’s needs always come first. Our business banking experts listen to needs and work to provide customized solutions to support your company’s growth and profit objectives. Our bankers are committed to superior responsiveness, local decision making, and the agility that allows our clients to choose the way they want to bank with us. To learn more, visit www.silvergatebank.com or contact Dino D’Auria at ddauria@silvergatebank.com.