August 17, 2016

The following content is from the August edition of the Business Forecast newsletter, sponsored by Silvergate Bank. To get these updates directly to your inbox, sign up here.

County’s business outlook continues to fluctuate, Index up five points this month

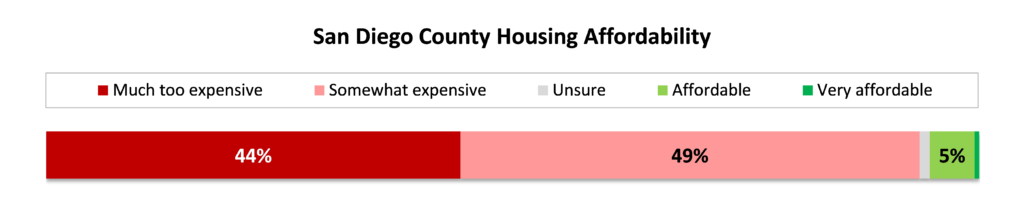

The region’s housing shortage continues to be a topic of much discussion and this month the Silvergate Bank-sponsored Business Forecast looks at what county businesses think of the issue. The findings reveal that nearly every businessperson (93 percent) in San Diego County believes housing in the area is expensive, and 44 percent say it’s much too pricey.

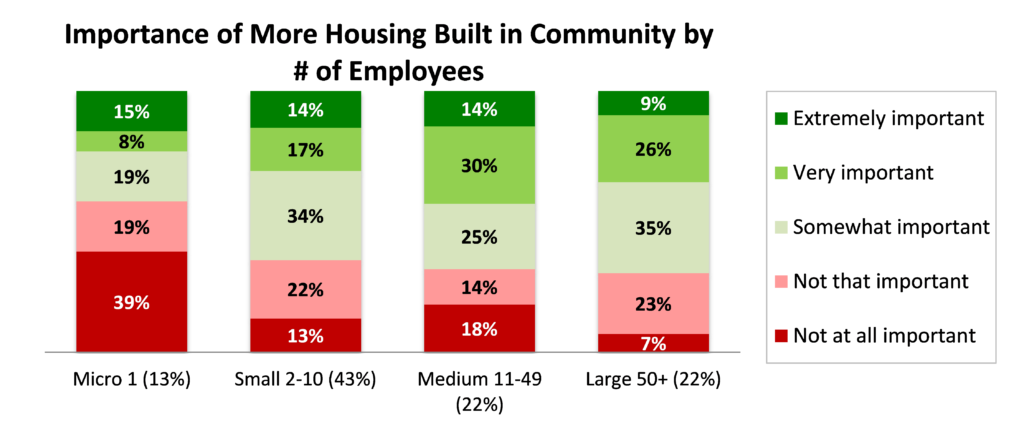

When asked about the importance of building more housing related to recruitment or employee retention, nearly two thirds (63 percent) of businesses see building additional housing in their community as at least a somewhat important thing to do. Where we find a difference on how important it is to build is between the smallest and the largest firms. Among micro firms with less than two employees, 58 percent believe building housing is unimportant. These firms are presumably less concerned with employee attraction and retention as owners run their operations. Larger companies see housing as more important than micro firms do.

Geography within the county also plays a role in housing costs. While no region of the county is immune to high housing prices, businesses in the north inland portion see the problem as less extreme. Only 28 percent of firms there say housing is much too expensive in that area, and 14 percent even believe it’s affordable. In contrast, 55 percent on the opposite side of the county, the south suburbs, believe prices are much too high.

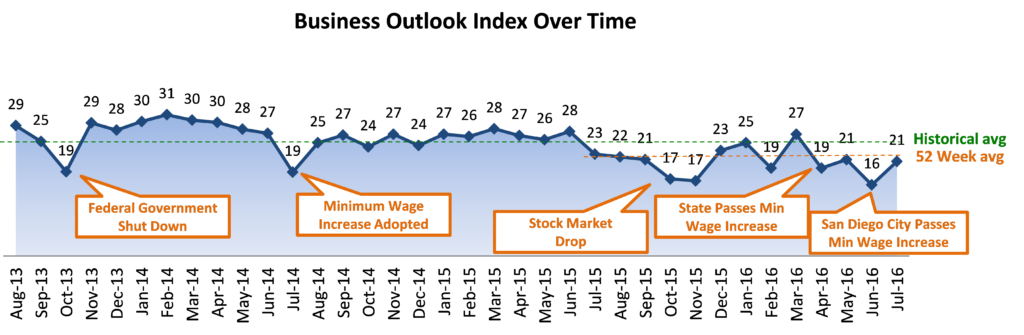

During the past six months, confidence among San Diego County businesses has been continually up-and-down. Those fluctuations in confidence continue this month as the Business Outlook Index (BOI) moved up about five points to 20.9. While this is a slight improvement over last month’s 15.7, the lowest point since the survey began in August 2013, it is still below the historical average of 25 and the 52-week trend has been downward. The BOI ranges from -100 to +100, with zero being neutral, so the overall outlook remains somewhat positive.

The year-long decline has mainly been due to businesses located outside the city of San Diego. Companies there are consistently less optimistic while those in the city have remained fairly stable in their outlook. One possible reason for this is that more growth-oriented companies are located in the city.

Two industries helping to keep the local economy on the brighter side are cyber-related firms and those in the development and construction sector. The IT, software, and on-line security professionals who make up the cyber sector have long been immune to pessimism, and lead the way with a strong BOI of 45. The development and construction industry is not far behind at 37 and see better conditions in their industry through the summer. These businesses are also more bullish about hiring with more than half saying they will add employees. Unlike cyber businesses, construction has been a roller-coaster since the Forecast began, but now the industry is settling into a more stable optimistic outlook.

This positivity is necessary for the county to maintain a moderately positive outlook. That’s because the city’s minimum wage increase and the state’s impending increase continue to weigh heavily on optimism. Firms seeing the mandated increases as a new challenge report a meager BOI of only 5. This is one more in a series of findings which show increasing the minimum wage saps the confidence of companies that are forced to deal with it. Currently 9 percent say it is the new challenge they deal with. Based on the trends of the previous months, it is likely that until those businesses absorb the increase, close, or leave the county, the overall outlook will suffer.

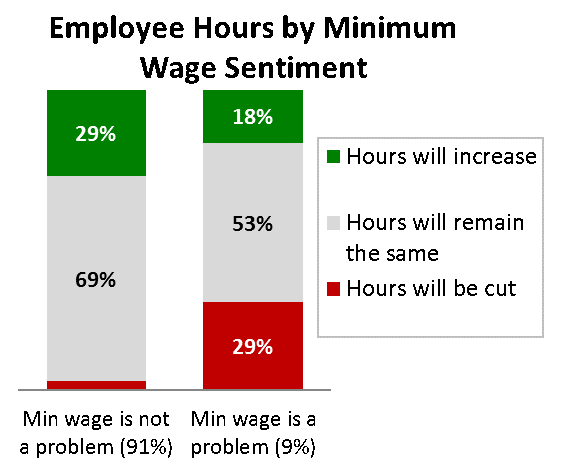

The effects that minimum wage increases have on business confidence can be seen in the hours companies are able to offer their employees. Among firms that see minimum wage as a problem, 29 percent will cut hours in the coming months and only 18 percent believe they will be adding hours for their workers. That’s nearly the reverse of what companies not affected by the wage increases tell us.