October 20, 2016

The following content is from the October edition of the Business Forecast newsletter, sponsored by Silvergate Bank. To get these updates directly to your inbox, sign up here.

The following content is from the October edition of the Business Forecast newsletter, sponsored by Silvergate Bank. To get these updates directly to your inbox, sign up here.

Business Forecast Highlights:

- No significant change in outlook, as BOI sits at 16.8

- Government-related challenges are sapping optimism

- Home and garden, hospitality, and transportation sectors are pessimistic

- 10 percent of businesses see the minimum wage increase as their main new challenge

- Few businesspeople perceive the workload in their industry as severe

- Nearly half believe a 30-hour workweek would hurt the bottom line

Majority view their industry as overworked and say 30-hour workweek would hurt bottom line

- No significant change in outlook, as BOI sits at 16.8

- Government-related challenges are sapping optimism

- Home and garden, hospitality, and transportation sectors are pessimistic

- 10 percent of businesses see the minimum wage increase as their main new challenge

- Few businesspeople perceive the workload in their industry as severe

- Nearly half believe a 30-hour workweek would hurt the bottom line

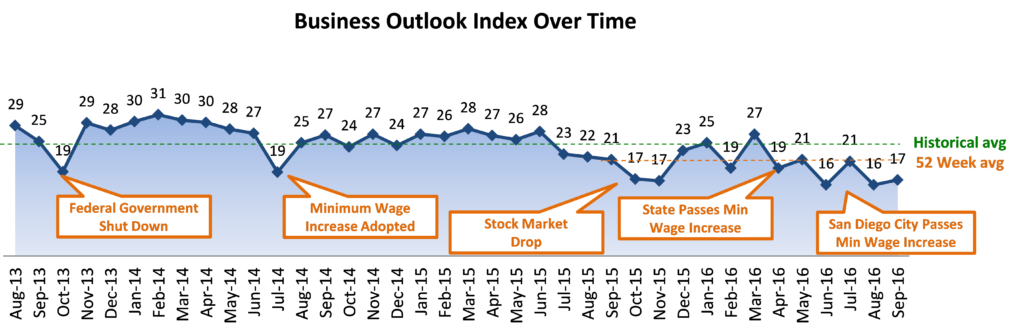

After testing a new low point last month, county businesses show little change in their optimism for the last quarter of the year. The Business Outlook Index in this month’s Silvergate Bank-sponsored Business Forecast rises just about a point to 16.8. This shows that San Diego’s business community continues to be moderately optimistic about its near-term prospects because the BOI ranges from -100 to +100, with zero being neutral.

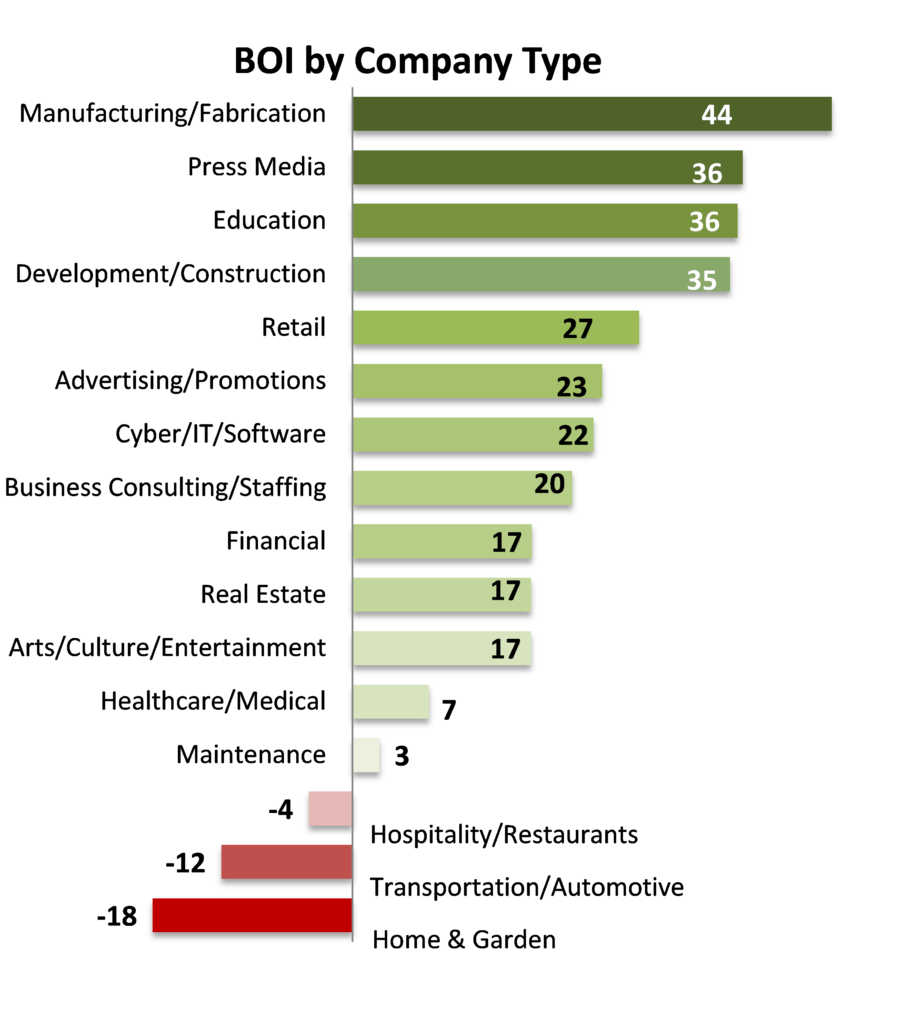

From a long-term perspective, the manufacturing sector has picked up steam over the last year. On the other hand, long-building pressure on maintenance firms and hospitality/restaurants has pushed their optimism lower during the past year. Optimism among small firms (2 to 10 employees) has also ebbed significantly over the past year.

In the short term, businesses in the transportation and automotive segment dropped into negative territory. The segment had recently been bouncing along in the mid-teens but the current BOI is at -12. Home and garden businesses as well as hospitality have also been hit particularly hard this month, which means three major sectors are now in negative territory.

The problems for transportation and home and garden companies generally stem from concerns about revenues and a pullback in terms of hours they will offer their employees. It’s not that they will curtail hiring, but more businesspeople in these firms see revenue deteriorating than improving during the next three months and they’ll pare back work hours.

The city of San Diego’s hourly minimum wage goes up (again) to $11.50 in January, while elsewhere in the County the minimum wage rises to $11. One out of every 10 businesses currently says these mandated increases are their main challenge. Including other regulations, 27 percent see their challenge coming from government, while 26 percent see the challenges coming from business conditions or their competitors.

This is important because it underscores the negative impact challenges stemming from Washington, Sacramento, or City Hall can have on business optimism. Businesses seem to deal fine with marketplace challenges like staffing, rising costs, growing pains or even increased competition. But those who see government as the challenge are down about their prospects, reporting a barely positive BOI of 2, while the rest are confidently humming along at a cheery BOI of 22.

Those facing government-related issues have a negative outlook on revenue, business conditions in their industry, and the number of hours they will be offering employees. Removing government barriers – like the minimum wage increase – would go a long way to improving the overall business outlook.

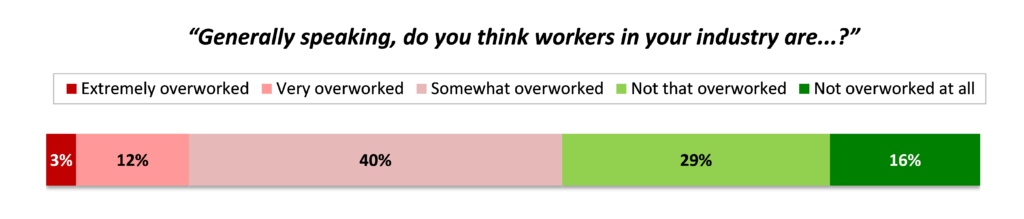

This month’s survey also touched on work-life balance asking about industry workload and impact of a 30-hour workweek. Few respondents perceive the workload in their industry as severe, although most regard workers as being at least somewhat overworked.

By industry, retail is one segment that clearly is not overworked. None in the retail industry rate the employees around them as overworked and 63 percent don’t think folks in retail are even somewhat overworked. Education, the media, and transportation are three other industries which do not have a significant number of very overworked employees, but none of them are quite as laid back as retailers.

When it comes to switching to a 30-hour week – like online retailer Amazon is testing – relatively few businesspeople believe such a change would help their bottom line. Only 15 percent feel it would and most of them do not see it making a big difference. On the other hand, 47 percent believe shortening hours would hurt the bottom-line.

There is a big difference between small and larger firms on this issue. The micro firms with only one employee tend to see a 30-hour workweek as having no significant impact, and those who do believe there would be an effect are basically split between it helping or hurting. Most larger firms, however, see the 30-hour workweek as deleterious.

Interestingly, firms challenged by minimum wage increases are not so quick to dismiss the 30-hour week. Twenty-eight percent of them see that possibility as actually helping their bottom line. Although 38 percent anticipate it would hurt profits, that perception is far less severe than it is for the rest of the business community. It’s apparent that some of those affected by state-mandated increases see reducing hours as a way out of wage inflation.